In Canada, all governments are legislated to produce financial statements that must be audited each year. This is required to reinforce transparency, evaluate the actual finances against budget, and support consistent financial reporting per Public Sector Accounting Standards (PSAS). However, it is important to emphasize the benefits for local government decision-makers. Local leaders should be able to depend on their financial statements to determine whether the goals, projects, activities, or strategic plans devised by staff and council are on track or whether they require realignment for the next budget cycle.

To build dependable financial statements, the finance department needs to have data that they can trust and a streamlined system to gather consistent and reliable information. At year-end, this can be a difficult task to maintain with a large backlog of data to analyze, material accrual accounting adjustments to be entered and without advanced software to maintain and organize the information. Local governments are often understaffed and overwhelmed with the annual auditing requirements, therefore making it incredibly challenging to complete a comprehensive review of all of the data and build confident financial statements.

Traditional Financial Reporting

The methods used to produce these legislated documents can vary dramatically across each organization. Many local governments use a corporate enterprise system to help organize and categorize the appropriate GL accounts to produce their financial lead sheets and the statements. However, the most common approach remains commonly the use of Microsoft Excel. Excel is a universally available software with very basic and broad capacities for calculation and graphing. Since the software is not inherently designed for strict budgeting purposes it leaves room for error.

Municipal practitioners are far too familiar with the errors that can occur with multiple users, such as lost data and misplaced formulas. Version control has the propensity to create additional errors where multiple people can be working on the same worksheet at different times, entering different data, so the latest version of the worksheet may not be properly used. It can also be difficult to ensure that formulas that span multiple tabs and various functions are used correctly and encompass all the required data. The most obvious flaws that accompany reliance on Excel for such an important annual activity have been exposed by COVID-19 and the requirement for more virtual and remote workplaces.

These concerns are also exacerbated during the annual audit process where supporting documentation must be shared with an external auditor to confirm the accuracy of the underlying data. Auditors can be extremely helpful to correctly organize and validate the financial information contained within the financial statements, however, in accordance with Canadian Public Sector Accounting Standards and Canadian Generally Accepted Auditing Standards, the auditor is not to prepare financial statements. Management is ultimately responsible for the preparation of the financial statements, where the auditor’s responsibility is to essentially confirm that the financial statements are free from material errors.

Financial Reporting with Government Budgeting Software

Specialized enterprise budgeting software like Citywide’s Budgeting software (formerly FMW) can address many of the roadblocks that local governments encounter. With Citywide Budgeting’s reporting tools, users can avoid manual formula and data entry, therefore, avoiding significant data gaps and errors. Local governments can effectively avoid the hurried scramble at year-end for financial reporting. The software has the capacity to engage in complex operational, salary, and capital planning and it can deliver custom reports. The reporting module enables users to summarize budget data by different categories, drill down into details, and even distribute the reports and charts through e-mail.

Citywide Budgeting is a multifaceted government budgeting software with enormous capabilities; however, some local practitioners and elected leaders do not have the time to train and become experts in the software. For this reason, local governments seeking to advance their financial reporting capacities turn to Software as a Service (SaaS). PSD’s financial consulting team is made up of chartered professional accountants, software developers, and public sector financial experts. PSD’s experts conduct in-depth data gap analyses to create a centralized dataset with accurately defined revenue sources and expenses. Through consultations with the municipal finance department, PSD’s experts build customized financial statements into the software.

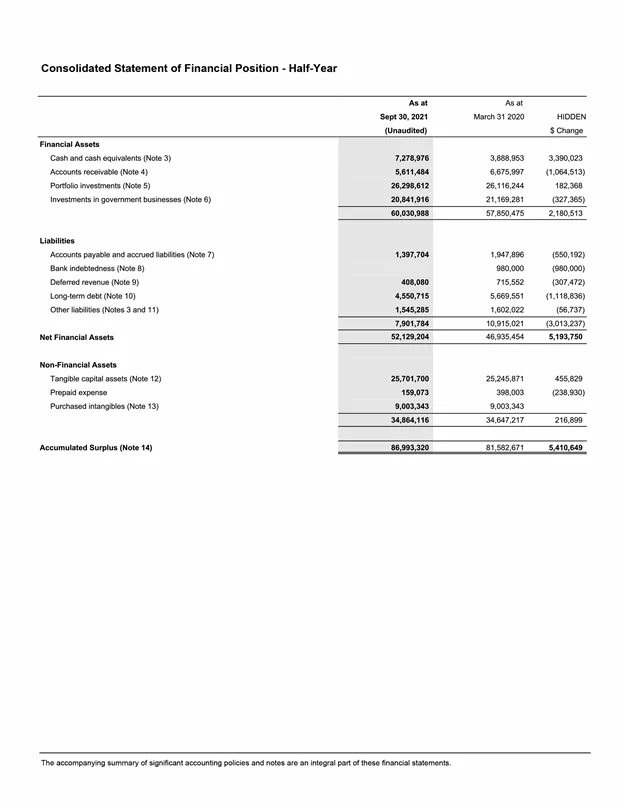

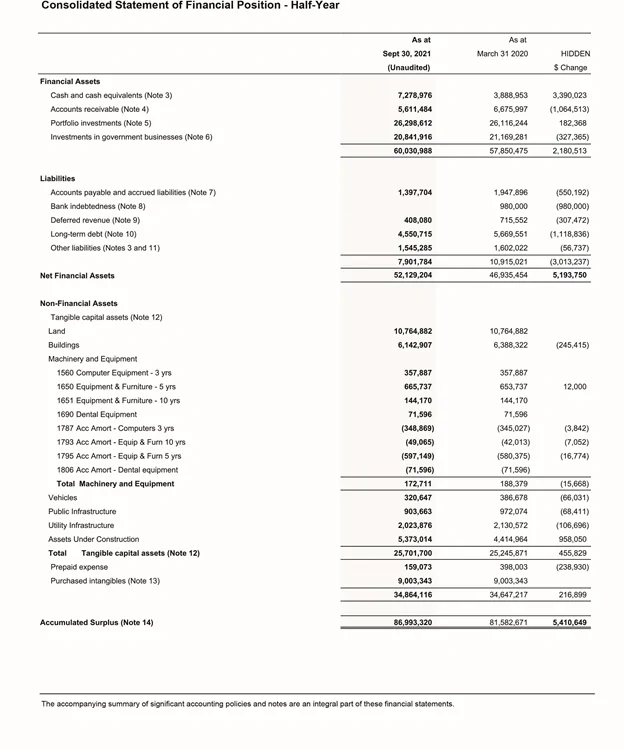

Once the implementation process is complete local governments can view their financial statements at any time with any new transaction that is posted in their GL. Citywide Budgeting can produce a full financial statement up to any point during the year, as well as department reports, variance analysis, and historical comparisons (see real examples below of unexpanded and expanded Consolidated Statements of Financial Position generated using Citywide Budgeting’s reporting tools). These features can improve communication with council, department managers, auditors, and the public. Stakeholders do not even need direct access to the software; the web-based viewer allows remote access to view reports through an e-mail file. Recipients of the file can drill-down to the GL level and more easily identify what accounts and activities make up specific line items.

Citywide Budgeting is a multifaceted enterprise system with enormous capabilities; however, some local practitioners and elected leaders do not have the time to train and become experts in the software. For this reason, local governments seeking to advance their financial reporting capacities turn to government budgeting software. PSD’s financial consulting team is made up of chartered professional accountants, software developers, and public sector financial experts. PSD’s experts conduct in-depth data gap analyses to create a centralized dataset with accurately defined revenue sources and expenses. Through consultations with the municipal finance department, PSD’s experts build customized financial statements into the software.

Once the implementation process is complete local governments can view their financial statements at any time with any new transaction that is posted in their GL. Citywide Budgeting can produce a full financial statement up to any point during the year, as well as department reports, variance analysis, and historical comparisons (see real examples below of unexpanded and expanded Consolidated Statements of Financial Position generated using Citywide Budgeting’s reporting tools). These features can improve communication with council, department managers, auditors, and the public. Stakeholders do not even need direct access to the software; the web-based viewer allows remote access to view reports through an e-mail file. Recipients of the file can drill-down to the GL level and more easily identify what accounts and activities make up specific line items.

Citywide Budgeting works in varying capacities with governments across Canada. Two unique cases came about in the middle of the COVID-19 pandemic: Peace River Regional District (PRRD) and Huu-ay-aht Government (HFN). In the coming months, PSD will be releasing full case studies of each of these use cases to share their experiences and how they were able to gain confidence in their financial statements.

Peace River Regional District (PRRD)

For many governments, financial reporting is a tedious and time-consuming task that is often met with overarching frustration from staff trying to ensure all data is accurate and up to date. With ongoing staff turnover and long-term improper data management tactics, it is difficult to always trace financial information, leading to accounting issues. In addition, many governments are preparing their annual financial statements within excel, further complicating the ability to validate and verify data. Peace River Regional District (PRRD) was experiencing many of these ongoing issues. With a new management team in place, they prioritized resolving these accounting issues and producing accurate 2019 statements. In order to do this, they leveraged the Reporting tool offered within the Citywide Budgeting system and the financial resource expertise of PSD.

PRRD was able to use the Citywide Budgeting’s powerful Reporting module to establish a better relational database for their GL data, which allowed management to build full financial statements from within the software system that appropriately linked all GL data to the corresponding line items of the statements, like a well-advanced pivot and lookup table. This greatly enhanced their overall processes and provided them with a central location to view and manage their data, which has been critical for data accuracy and improving their ability to trace financial information. In the past, PRRD has struggled with their audit process, adding to the headache of annual reporting.

However, through the use of an enterprise system, management had confidence that the treatment of GL data was consistent across each statement and note disclosure. Because the statements allowed for the GL data to be easily tied across statements and produce the appropriate lead sheets and supporting evidence for the report design, it allowed for a much improved audit process and zero suggested entries from the auditor. The ability to use the PSD Citywide Budgeting software significantly improved their overall annual reporting process, in addition to their day-to-day operational use of financial data.

HUU-AY-AHT GOVERNMENT (HFN)

First Nation governments in Canada face challenging financial reporting requirements. In addition to the standard annual set of audited financial statements, First Nations governments have complex funding structures, distinct accounting requirements for government owned businesses, and non-standardized government transfer reporting. It can be difficult to maintain cohesive and centralized datasets that comprehensively distinguish and define revenue sources and expenses. One such case is Huu-ay-aht Government (HFN). HFN is a self-governing treaty Nation located on Pachena Bay on Vancouver Island.

In March of 2020, HFN found itself in need of support. Council was struggling to prepare last year’s financial statements and the next year’s budget amid the sudden departure of their CFO and the beginning of the COVID-19 pandemic. HFN connected with PSD’s financial consulting team and immediately jumped into action. PSD’s accounting professionals and software experts developed a solution through SaaS. A member of PSD’s team acted as interim CFO to guide the development of accurate and informative financial statements using Citywide Budgeting software.

Through an extensive data gap analysis, a new centralized database for their general ledger (GL) was created. The new database accurately defined every revenue source and expense. Once the datasets were uploaded into the software, they were able to build customized reports for their specific needs. Councillors can now request to view financial statements at any time throughout the year. They are also able to compare and contrast statements from the last five years. Long-term planning is only made possible with knowledge of past surpluses and deficits. HFN staff and councillors took decisive action to advance their financial planning capacities. When faced with unprecedented challenges, they developed a permanent solution by ensuring accurate financial reporting based on data that they can trust.